Why is getting your business’ financial energy right so important?

The whole point of running a business is to make money. If you don’t you can be closed down. Even Not For Profit organisations need to make money if they want to continue making a difference in their chosen sphere of operations.

Yes, there may be other reasons you choose to own and run a business rather than just get a job but fundamentally, all those other reasons become impossible to sustain if your business does not make money.

So what do we mean by “making money”? Does that sound like a strange question? Surely it’s obvious? Well, maybe, but I come across many businesses that focus on one or two aspects of making money but still never seem to have cash in the bank.

Before we delve deeper into this, there’s a handful of fundamental principles we need to outline in order to make sure your business has the financial energy to thrive.

- Understanding your margins and where each product or service makes money is vital.

- Even profitable businesses can go to the wall if they run out of cash.

- Cash is the fuel in your business’ tank. With it, you can go as far and fast as you like, without it, the journey will end.

- Turnover is not the ultimate goal but has an important role to play in the overall financial health of your business.

Think of it like this:

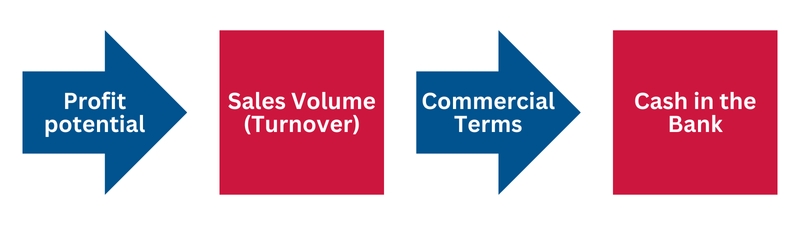

The blue arrows are the conditions for success you need to set up. The red blocks are the areas you need to take action in.

Let me explain. If your margins are too low (first blue arrow) then as you sell more and more through lots of activity (first red block) your problems just get worse. Likewise, if your margins are fabulous but your volume is too low, your business still won’t make money.

In the second half of the diagram, if your commercial terms are too generous, then no matter how profitable your business, you risk running out of cash. Or if you have strong commercial terms but don’t enforce them through the right kind of activity, you’ll still run out of fuel (cash). The other hidden trap here is when your commercial terms mean that the faster you grow the greater the risk of running out of the working capital you need to finance that growth (inventory, credit terms etc).

This isn’t just a problem for small businesses either, this happens in a lot of much larger businesses too, especially as they grow quickly and get more and more complex.

How to make sure your business has the Financial Energy to succeed and prosper

So how do you go about making sure that your business has the Financial Energy to succeed and prosper? Well, it’s a combination of setting the right conditions for success (the potential to make money and the commercial terms that will allow that to happen) and the activity you put in place to make those conditions work for you.

We cover marketing, sales and volume growth in other articles in this series so for now, here’s the 4 main things you need to take care of to make sure your business’ financial energy is working for you rather than against you.

1. Understand your margins both at a Gross Margin and Operating Margin level for your business and at the level of each product or service you deliver.

Once you have transparency across all your products or services and at gross and operating margin level, you will be able to see which areas of your business are serving you well and which need to be improved. You’ll also get clarity on exactly what your business needs to do to hit the profit margins and profit levels you want. From this understanding comes the skeleton of the plan to market and sell the right volumes of the right products or services to fulfil the wider goals of your organisation. This is where you establish the profit potential of your business in its current form and identify ways to increase that potential in the future.

2. Review and adapt your Commercial Terms

Every business works to commercial terms. Things like, when can you invoice? What are your payment terms to suppliers? What are your payment terms to customers? When are staged payments applicable? What levels of bonds or retentions are you signing up to? How will payment be made? Etc etc.

Often these are terms that have just been imposed on a business. Sometimes they are negotiable, sometimes not but there is always a choice. And you don’t have to work to the same terms for every product, service, customer or supplier. How can you adapt your terms to work for your business rather than against it? I hear time and time again the argument that “terms are industry standard” but this is just not true. You may not be able to have everything all your own way but I’ve not yet come across a business that couldn’t improve their commercial terms in any way. And it starts with understanding them.

3. Invoice correctly, on time and regularly

Another simple thing to say but making sure you invoice correctly and on time can often make a big difference. Depending on your payment terms with your customers a day late in invoicing can mean a delay of a month in payment.

Invoice errors are often a problem for smaller businesses especially if invoices are raised or sent in bulk once or twice a month. Generally your customers will spot and inform you of invoice errors in their favour (and this will delay payment by a further month in a lot of instances) but how sure are you that your customers would inform you if your business had undercharged them?

A simple system to raise and send invoices automatically on delivery or job completion can make or save your business a fortune.

And it’s important to note here that the impact of not invoicing even a minor part of the order can be huge because every pound not invoiced comes straight off your profit line. This means (if you have a 15% Operating Margin) that for every £150 not invoiced or invoiced incorrectly you’ve wiped out the whole point of £1,000 in sales. And how hard did you work to make those sales?

4. Set up a cash collection process

I was taught in my first commercial role that you’ve not made a sale until the money’s in the bank. I probably didn’t understand this way back then to the extent that I do now having run multiple businesses over the years.

It’s all very well doing the work at good margins, invoicing correctly and on time, having the best sales year in the history of the company etc etc but if customers don’t make payment on time, that will all come to nothing. And it doesn’t take a lot of your customers to not pay on time before you have a major problem.

If we take the 15% Operating Margin example again, this means that 85% of the cash your business generates flows out again in costs of some sort. You’ll also have to pay tax on that 15% of invoiced profit even if you haven’t collected the cash in most cases.

This means that if somewhere between 10% and 15% of your invoiced sales pay late (or worse, not at all), you’ll be consuming cash rather than generating it each month. So how much do your customers currently owe you? Do you know your debtor profile and who pays on time (and who doesn’t)?

What system does your business have in place to make sure you always get paid on time? This doesn’t have to be complex or confrontational. A couple of simple changes to the way you work can often deal with this issue.

So when we talk about Financial Energy there’s a few moving parts that need to work well together to make sure your business can thrive. And if you’re thriving financially, the choices and options you have multiply exponentially – this is when things get really exciting. So take a look at the conditions you’re setting around your business first. Are you set up to make money and collect cash in a way that works for you rather than against you? Then put the activity in place to capitalise on those conditions.

We work with business owners and MD’s to help gain clarity on their goals. If you’re struggling with where to start, why not schedule a conversation with us? It’s free and at the very least you’ll come away with a couple of ideas to help you move forward.